A big lower in energy prices has truly decreased common month-to-month rising value of residing again proper into the reserve financial institution’s goal, as residence mortgage house owners maintain on to hopes of a value lower.

Inflation cooling right down to 2.7 % within the 12 months to August, under 3.5 % in July, introduced it to its flooring in virtually 3 years, primarily off the rear of energy aids.

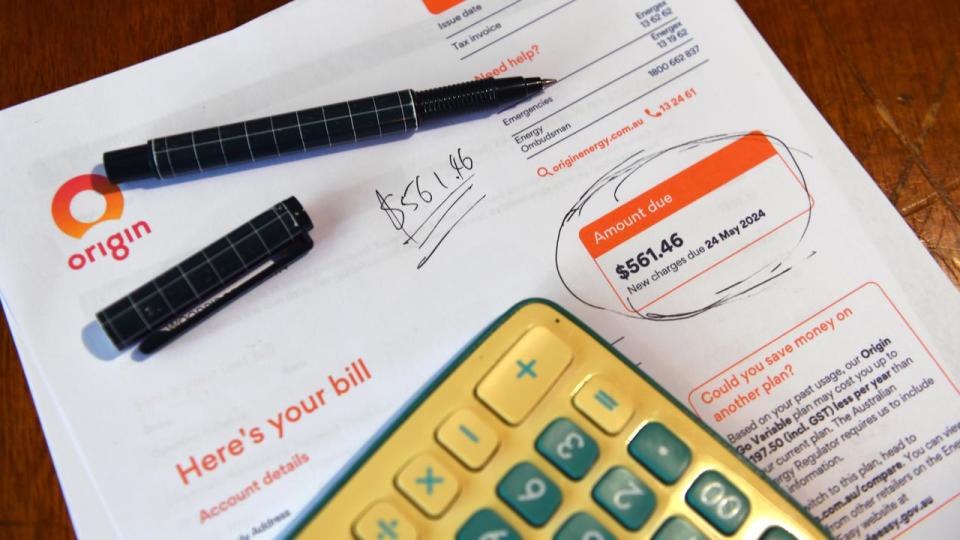

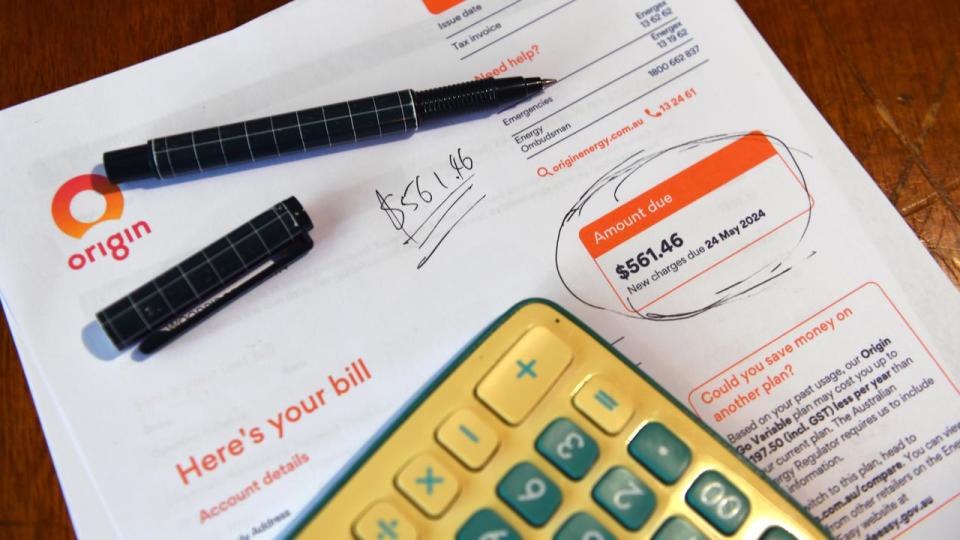

Federal and state energy aided convey energy bills down 17.9 %, the largest yearly autumn on doc.

Electricity bills will surely have leapt 16.6 % provided that June 2023 with out the refunds, in keeping with the Australian Bureau of Statistics.

While rising value of residing is monitoring in the very best directions, it’s not all wonderful data for residence mortgage house owners, with the lower imply – a quantity that removes uneven or momentary prices changes – may be present in at 3.4 % in August.

Although under 3.8 % in July, it’s nonetheless over the Reserve Bank’s goal band and the reserve financial institution pays much more focus to this scale of underlying rising value of residing when making costs selections.

The yearly lower quantity ignored the drops in gasoline and energy.

The volatility of the common month-to-month quantity made it a lot much less outstanding than the quarterly one, subsequent due in October, RBA guv Michele Bullock acknowledged.

Alcohol and cigarette prices climbed 6.6 %, meals and drinks 3.4 %, and actual property 2.6 % within the 12 months to August, nonetheless transportation dropped by 1.1 %.

Fuel sank 7.6 %.

Interest value walks have truly regarded for to take the wind off the rear of the financial scenario and slow-moving rising value of residing nonetheless a value lower isn’t anticipated up till 2025 after the RBA held costs at 4.35 % on Tuesday.

National Australia Bank aged financial professional Tapas Strickland anticipated the heading common month-to-month quantity won’t make any type of distinction to the chance of the reserve financial institution decreasing costs

He anticipates the preliminary lower in May, whereas financial specialists at ANZ and Westpac have truly penned one in for February.