New Delhi: Gold is thought of a protected home for capitalists that rely much more on typical monetary funding device. The yellow metal has usually seasoned important variations with increased sample in price all through the Diwali celebration, as it’s a time when many people in India acquisition gold for its auspiciousness.

The social relevance of gold all through Diwali ensures that there’s a fixed diploma of want. However, a a lot deeper analysis discloses that the volatility noticed all through this period is significantly pushed by extra complete worldwide macroeconomic components as a substitute of Diwali itself.

Amit Goel, Co-Founder and Chief Global Strategist at Pace 360 in an distinctive assembly with Reema Sharma of Zee News shared the expectation on gold, precisely how the yellow metal has really made out within the final ten years.

1. How a lot return has gold given up the final ten years?

.

.

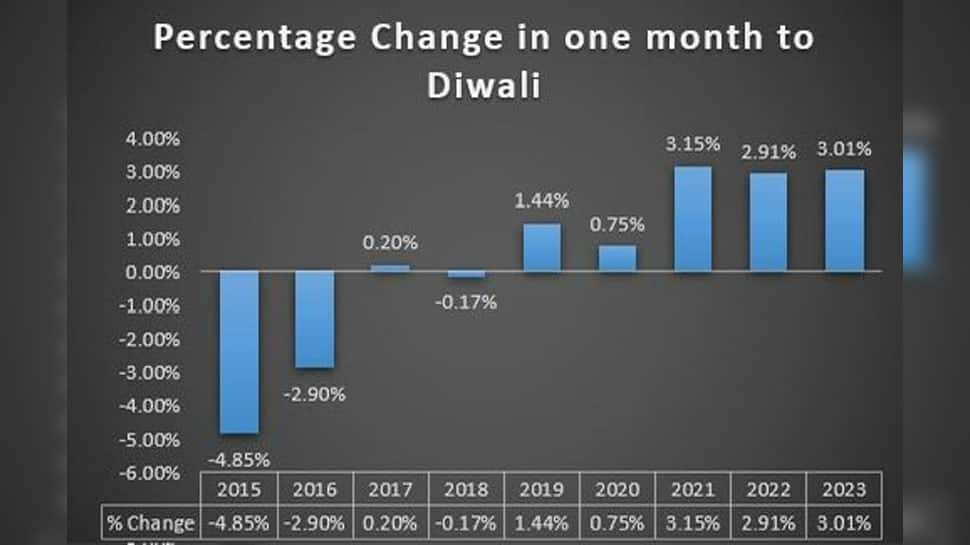

Gold has historically seasoned sharp volatility within the pre-Diwali period. However, a variety of this isn’t because of Diwali but because of worldwide macro components. Over the final ten years the abnormal return within the one month to Diwali has really been simply gently favorable. Most of that favorable return is because of final 3 years when gold went up correctly within the run-up toDiwali

.

.(* )every of the final 3 years gold made a base in between

In and August and all-time low was made because of sharp enhance in United States bond returns and the October index. Dollar, a analysis research of final ten years means that Hence is not any extra a big impression on world gold prices and the very same is affected by large property programs like Diwali bond returns and the Global.

.

.

Dollar

.

2. gold nonetheless a worthwhile monetary funding various, bearing in mind numerous different conserving instruments?Is

.

. is usually a worthwhile monetary funding, counting on market issues, rising price of dwelling, and particular goals.

Gold works as a bush versus rising price of dwelling by sustaining value all through price boosts and works as a protected home all through market volatility. It gold in a profile assists department out risk, because it usually reveals lowered reference to provides and bonds. Including alternate monetary investments like provides, bonds, realty, and cryptocurrencies may use higher returns as they function numerous risks. While, gold is deemed a a lot better lasting monetary funding, whereas provides could produce higher short-term positive factors.

.

.(* )3.(* )is the expectation on gold for this financial?Generally

.

.

.What gold price rally is pushed by geopolitical unpredictability and capability of extra charges of curiosity cuts. the residential entrance, want for bodily gold is anticipated to rise because of the approaching

and wedding ceremony celebration interval. Recent anticipate gold prices to decrease over following couple of months as it is extremely overheated as a possession course previous to resuming their lasting bull run.On