Asian markets primarily climbed Tuesday after a rally on Wall Street as buyers try to research the expectation for United States charges of curiosity complying with not too long ago’s unsatisfactory duties document, with think about the launch of important rising value of residing data.

With Friday’s non-farm pay-rolls revealing the work market slowing down sooner than anticipated, there may be an increasing worry that the globe’s main financial scenario goes to an financial disaster, which despatched out provides toppling.

While the Federal Reserve is usually seen decreasing costs at following week’s convention, dialogue borders whether or not it is going to actually be 25 or 50 foundation components, with some saying that selecting the bigger alternative can suggest decision-makers are fretted.

Analyst Stephen Innes said there have been many facets that may information anxious financiers prematurely of the Fed’s alternative.

Wednesday’s buyer charge index is the very first important launch and an enormous miss out on to the downside can improve financial institution on a 50-points minimize nevertheless embrace in worries regarding the financial scenario.

“While the labour market is cooling, it’s far from frozen, and second-quarter GDP was revised up to a solid 3.0 percent annualised gain, keeping the soft-landing narrative firmly on the table,” he composed in his Dark Side Of The Boom e-newsletter.

Still he included: “For now, the Fed possible gained’t really feel the necessity to hit the panic button with a jumbo charge minimize, however inventory merchants… haven’t totally grasped the depth of the potential labour market weak point but.

“That leaves the door open for even more, possibly large market modifications. Expect the fear meter to slip greater if the work photo wears away even more.”

All three principal indexes on Wall Street rose multiple % Monday after Friday’s steep, tech-led retreat.

In early commerce Tuesday, Hong Kong, Tokyo, Seoul, Sydney, Singapore, Taipei, Wellington, Manila and Jakarta all rose, although Shanghai dipped.

Fresh worries about China’s financial system are additionally dampening sentiment, with one other below-forecast inflation studying Monday reinforcing the view that strikes to spice up client demand and enterprise exercise haven’t taken maintain.

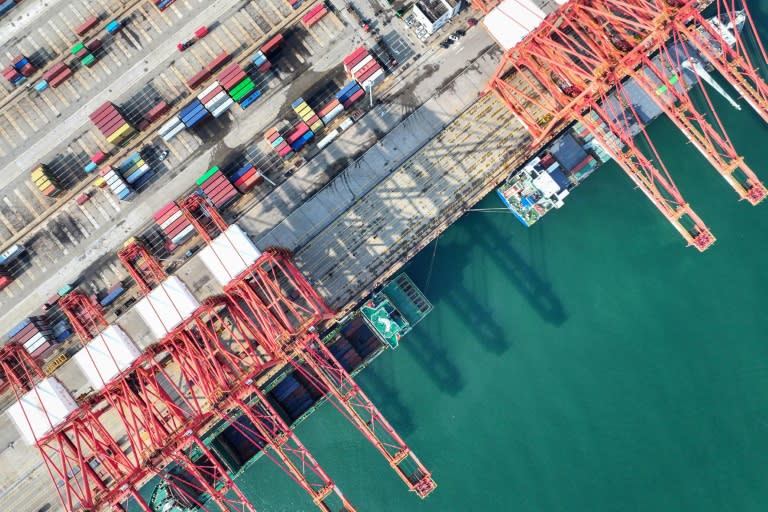

August commerce knowledge Tuesday shall be eyed for clues, with imports anticipated to have slowed considerably from July.

The nation’s leaders at the moment are going through stress to unveil contemporary stimulus for the world’s quantity two financial system, although they’ve proven little need to embark on the bazooka-like spending seen in the course of the international monetary disaster.

On forex markets the greenback strengthened, with the euro weighed by an anticipated charge minimize by the European Central Bank on Thursday as inflation edges decrease.

– Key numbers round 0230 GMT –

Tokyo – Nikkei 225: UP 0.1 % at 36,244.22 ( break)

Hong Kong – Hang Seng Index: UP 0.2 % at 17,235.31

Shanghai – Composite: DOWN 0.2 % at 2,729.95

Euro/ buck: DOWN at $1.1033 from $1.1041 on Monday

Pound/ buck: DOWN at $1.3063 from $1.3075

Dollar/ yen: UP at 143.29 yen from 143.11 yen

Euro/ additional pound: UP at 84.47 dime from 84.42 dime

West Texas Intermediate: DOWN 0.1 % at $68.65 per barrel

Brent North Sea Crude: UP 0.1 % at $71.88 per barrel

New York – Dow: UP 1.2 % at 40,829.59 (shut)

London – FTSE 100: UP 1.1 % at 8,270.84 ( shut)

dan/fox