Chancellor Rachel Reeves is encountering additionally tests in advance of her very first Budget this fall after main numbers exposed federal government loaning leapt without a doubt greater than anticipated last month.

The Office for National Statistics (ONS) claimed public field web loaning stood at ₤ 3.1 billion last month– ₤ 1.8 billion greater than a year earlier and the greatest July loaning given that 2021.

The overall for July was ₤ 3 billion greater than anticipated by Britain’s main forecaster, the Office for Budget Responsibility (OBR), and more than the ₤ 1.1 billion most economic experts were booking.

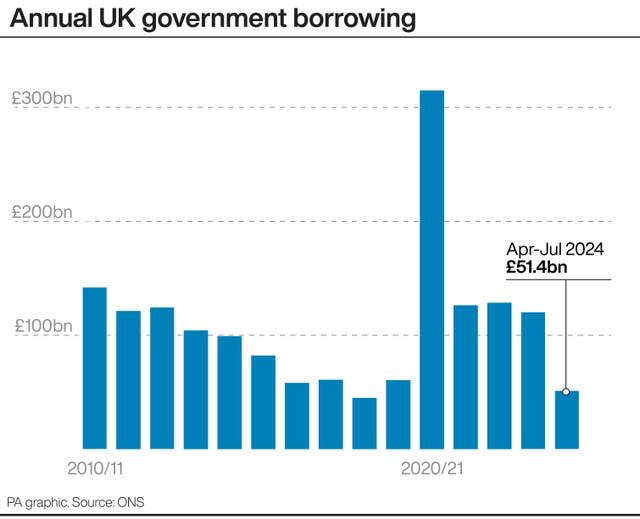

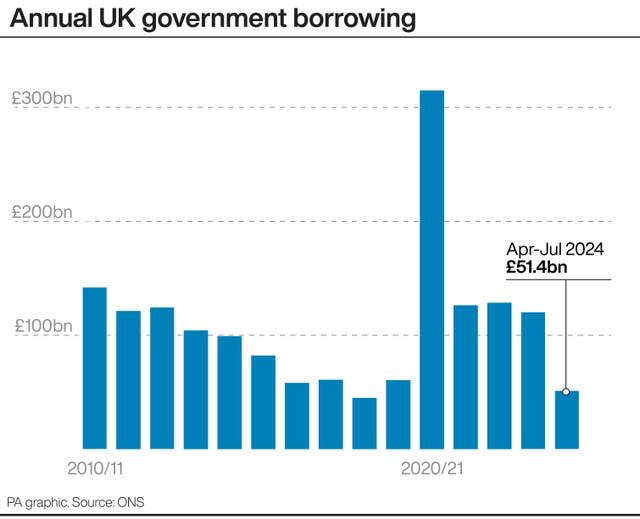

Borrowing in the fiscal year from completion of March to July was ₤ 51.4 billion, ₤ 500 million much less than in the very same four-month duration a year previously, yet the 4th greatest year-to-July loaning given that regular monthly documents started in January 1993, the ONS claimed.

This is in spite of obtaining for June being changed to ₤ 13.5 billion from the first quote of ₤ 14.5 billion.

It follows the brand-new Chancellor last month charged the previous Conservative federal government of leaving a ₤ 21.9 billion great void in the general public financial resources, via unfunded dedications that she claimed it had “covered up”.

Chief Secretary to the Treasury Darren Jones claimed: “Today’s figures are yet more proof of the dire inheritance left to us by the previous government.

“A £22 billion black hole in the public finances this year, a decade of economic stagnation and public debt at its highest level since the 1960s, with taxpayers’ money being wasted on debt interest payments rather than on our public services.”

The ONS numbers revealed that public field costs of ₤ 107.4 billion last month– up ₤ 3.5 billion year-on-year– much surpassed invoices of ₤ 91 billion in what is usually a bumper month for tax obligation incomes.

Public field web financial obligation leaving out public field financial institutions was ₤ 2,745.9 billion at the end of July 2024, provisionally approximated to be around 99.4% of the UK’s yearly gdp. pic.twitter.com/3fxA1lsUex

— Office for National Statistics (ONS) (@ONS) August 21, 2024

The ONS information additionally exposed that public field web financial obligation leaving out state-owned financial institutions was approximated at 99.4% of gdp (GDP) at the end of July; this was 3.8 portion factors greater than a year earlier and continues to be at degrees last seen in the very early 1960s.

Jessica Barnaby, replacement supervisor for public field financial resources at the ONS, claimed: “Revenue was up on last year, with income tax receipts in particular growing strongly.

“However, this was more than offset by a rise in central Government spending where, despite a reduction in debt interest, the cost of public services and benefits continued to increase.”

Government loaning in July is generally reduced many thanks to a rise in self-assessment tax obligation invoices, with a document ₤ 12.9 billion being gotten in July.

But July’s information revealed skyrocketing public costs as social advantages jumped greater as a result of current inflation-linked boosts.

The numbers do not yet take into consideration the current round of public field pay increases introduced by the Labour Government.

Ms Reeves last month dropped wintertime gas allocations for 10 million pensioners as component of prompt activity to attend to a shortage in the general public financial resources by ₤ 5.5 billion, with the remainder of the space to be taken on at a Budget on October 30.

Experts are alerting that the most up to date collection of loaning numbers elevate the specter of additional tax obligation increases and even more loaning to cover costs on civil services.

Recent better-than-expected development numbers, which saw GDP climb by 0.6% in between April and June, are not anticipated to soften the strike.

Isabel Stockton, elderly study financial expert at the Institute for Fiscal Studies, claimed: “The early signs are that better-than-expected growth figures won’t be enough save Rachel Reeves from tough choices in her first Budget on October 30.

“The combination of in-year spending pressures identified at last month’s spending audit and the ongoing, and well known, pressures facing many public services suggest that the accompanying spending review for 2025-26 could be a particularly difficult exercise.”

&w=1068&resize=1068,0&ssl=1)