The steady drip, drip of enterprise being taken management of or delisted from the London Stock Exchange, and the absence of a pipe to vary them, is making it considerably testing to find superb, underestimated possibilities there. That suggests it’s much more essential for financiers to behave quickly and with sentence when possibilities emerge.

Filtronic (Aim: FTC) is one such risk. It is a UK-based developer and producer of high-performance radio-frequency microwave and millimetre-wave parts and subsystems for the aerospace sector. Over the earlier years, it has truly taken a world-leading specific area of interest on this fringe of {the marketplace}, and in the present day it’s profiting.

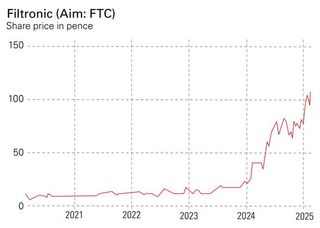

Filtronic’s modification in ton of cash

Historically, Filtronic’s 3 major areas of job have truly been cellular telecoms framework, safety and aerospace, and public safety. Orders from these industries gave a steady stream of earnings, but the corporate had a tough time to increase and to differentiate itself in a really inexpensive sector. Revenue gone stale, as did the shares. After Filtronic relocated from the first market to Aim in 2015, the provision rarely traded over 10p per share.

Subscribe to Money Week

Subscribe to Money Week in the present day and procure your preliminary 6 publication issues undoubtedly FREE

Get 6 points free

Sign as a lot as Money Morning

Don’t miss out on the freshest monetary funding and particular person funds data, market analysis, plus money-saving solutions with our completely free twice-daily e-newsletter

Don’t miss out on the freshest monetary funding and particular person funds data, market analysis, plus money-saving solutions with our completely free twice-daily e-newsletter

The overview started to change in 2021 when European nations began elevating safety investing in response to Russian aggressiveness. The firm moreover started to usher in fee of curiosity from the space sector, as enterprise corresponding to Elon Musk’s Space X began to launch satellite tv for pc constellations in elevating numbers. Space X and varied different subject innovators have truly reworked to reduced-Earth orbit (LEO) satellite tv for pc constellations to perform worldwide safety at a portion of the worth of normal geostationary orbital satellites (GEO). LEO constellations make up numerous smaller sized satellites, which may be launched in huge groups, mass-produced, and make the most of every varied different to boost array. Space X began releasing its Starlink LEO constellation in 2019, due to this fact a lot it’s positioned better than 7,000 proper into orbit. As a number of as 55,000 LEO satellites is perhaps launched within the coming years.

Filtronic launched its preliminary assortment of agreements to offer LEO satellite tv for pc interactions instruments in 2023. One association was with the European Space Agency, price a complete quantity of ₤ 3.2 million, to create multi-frequency transceiver fashionable know-how for satellite tv for pc haul feeder internet hyperlinks. The assortment of smaller sized agreements assisted the enterprise purchase a facet within the market whereas reinvesting cash in r & d. These monetary investments completed in a transformational long-lasting collaboration association with Space X in April 2024.

Filtronic connecting arms with Elon Musk

SpaceX has truly related Filtronic proper right into a cut price to acquire its palms on the enterprise’s E-band robust state energy amplifiers. These devices support floor terminals work together with Space X’s Starlink constellations and, due to this, are crucial to the process.

Under the regards to the association, Filtronic supplied warrants to Space X, enabling the final to subscribe for as a lot as 10% of enterprise with a five-year vesting length. The warrants vested in 2 equal tranches based mostly upon the amount of orders– the preliminary after $37 million in orders and the 2nd on the equilibrium as a lot as a complete quantity of $60 million. Space X moreover set out put together for the long run technology of those devices. The 2nd tranche of warrants is related to the extra development of the trendy know-how.

In Filtronic’s 2024 fiscal yr, earnings climbed 56.3%, and incomes previous to fee of curiosity, tax obligation, devaluation and amortisation (Ebitda) leapt 280%. In the preliminary fifty p.c of the enterprise’s 2025 fiscal yr, earnings climbed by 202%, primarily pushed by the Space X settlement. Following 2 years of improvement, consultants at Cavendish had truly anticipated earnings to drop in financial 2026 because the preliminary stage of the settlement with Space X completed. Cavendish booked earnings of ₤ 48.4 million in financial 2025, being as much as ₤ 41 million in financial 2026. It anticipated improvement to re-accelerate in financial 2027 because the 2nd stage of the Space X settlement started to settle. But on 10 February, Filtronic shocked {the marketplace} by revealing it had truly received a brand-new settlement with Space X valued at $20.9 million (₤ 16.8 million) to be met in 2025 and 2026.

Filtronic grabs the celebrities

This cut price was but yet another indication of precisely how transformational the Space X preparations have truly been and precisely how administration has truly launched the money cash to drive extra improvement. Filtronic has truly spent enormously to meet the wants of its vital agreements with Space X, and it stays to take action. The enterprise’s capital spending accomplished ₤ 2.1 million within the preliminary fifty p.c of the yr and is anticipated forward in at round ₤ 2.4 million within the 2nd fifty p.c of the yr. Even hereafter improvement, Cavendish had Filtronic ending the yr with ₤ 10.4 million in web money cash, up 100% yr on yr. Thanks to the bespoke unique nature of its fashionable know-how, its Ebitda margin was 19.2% in 2024 and anticipated to strike 28.3% in 2025.

Filtronic’s direct publicity to at least one key shopper is harmful, but it’s profitable prospects, leveraging its expertise coping with Space X to achieve entry to numerous different parts of the LEO market. Profit created from the cut price is moreover moneying substantial r & d to drive improvement in varied different markets. Based on the enterprise’s most up-to-date cut price, the provision is buying and selling at an onward price/ earnings (p/e) ratio of about 20 on a completely weakened foundation after eradicating out money cash. Even although the provision has truly climbed in price 10 instances contemplating that 2021, its present price isn’t additionally requiring, contemplating its market suggestion and merchandise base.

The enterprise is moreover a major procurement goal. Compared to numerous different Space X distributors within the community interactions subject, corresponding to Taiwan- based mostly Wistron NeWeb Corp, Filtronic is a minnow and would possibly find yourself being a particularly interesting bolt-on procurement.

(Image credit score rating: Aim)

This write-up was preliminary launched in Money Week’s publication. Enjoy particular very early accessibility to data, standpoint and analysis from our group of economists with a MoneyWeek subscription.